The Premier of Ontario, and its Minister of Energy, held a news conference today in which they promised to cut electricity bills by 25 per cent - on average, inclusive of an 8% sales tax rebate already introduced. A Fair Hydro Plan is touted as offering these "new" things:

Starting this summer, electricity bills will be reduced by 25% on average for households across Ontario. Many small businesses and farms will also benefit from this cut.I found none of the government's posted material informative.

And bills won’t increase beyond the rate of inflation for at least four years.

People who live in eligible rural communities and those with low incomes will see even more reductions to their electricity bills.

Taken together, these changes will deliver the single-largest reduction to electricity rates in Ontario’s history.

Ontario consumers, particularly those of Hydro One, are advised to skip government explanations and go to Hydro One's examples of cost impacts for different customers. Hydro One summarizes changes:

- Reducing the Global Adjustment charge by 20 per cent,

- Lowering the delivery charge for low-density customers,

- Accelerating the move to more fixed delivery charges,

- Introducing an affordability fund to help those customers in need, and

- Introducing a First Nations electricity rate.

The move to fixed delivery charges is one I approve of, but it may be of limited interest as it impacts individual consumers (the higher consumption user, including farms, benefit at the expense of low consumption residences).

In the remainder of this post I'll pull some evidence together to speculate on how the government intends to reduce the global adjustment charge by 20 per cent, and the implications of doing so.

An extremely quick review of the global adjustment: Essentially all Ontario generators are guaranteed payments, but there is a market operated. The market, such as it is, does not recover enough to pay the generators contracted, or regulated rates - and the difference is the global adjustment.

If X is the contracted rate, and Y is the price the market recovers, Z is the global adjustment:

X - Y = ZI tried to get confirmation as to whether contracts (X) would be renegotiated, and the best information I received, from the Globe and Mail's Shawn McCarthy, was this was not being looked at. So... where Z is a calculated figure, the government is promising to reduce it without addressing the variables that produce Z.

Smell a con?

McCarthy reported:

"We're refinancing the mortgage and setting a new term that stretches over a longer period," Ms. Wynne said.A significant problem with this explanation is that Ontario hasn't built much debt in building public generation since 1993. The bulk of the costs recently are from contracts. Since 2008 the vast majority (over 90%) of new-build generation is based on the German model of feed-in-tariff (FIT) contracts, mostly for a duration of 20-years. The following chart, of global adjustment components, shows how small the share of publicly owned, and financed, generation (OPG) is compared to contracted supply including OEFC (older), and more recent contracts signed by the OPA (IESO).

"Over time, it will cost a bit more. And it will take longer to pay off. But it is fairer – because it doesn't ask this generation of hydro customers alone to pay the freight for everyone before and after. The burden will now be shared more evenly and more appropriately."

It seems the current Ontario government intends on paying out the contracts, as signed, but financing the payments with debt replacing 20% of the global adjustment mechanism.

I don't know if this is in keeping with any level of accounting standard. The Office of the Auditor General of Ontario has provided great insight into the electricity debacle (significantly in both 2011 and 2015 annual reports), and hopefully they'll delve into the implications of intending to collect payment from ratepayers years after the contracts have ended.

The Premier justifies stringing out the payments by explaining that although the contracts are for 20-years, the generators will last longer than that. Perhaps she's been convinced these generators will continue to operate after 20 years for just the market rate, but that's staggeringly ignorant thinking in 2017 as:

- in the free-market U.S., even in Texas which is closest to a pure energy market, major generators consider the independent power producer model 'obsolete' -

- Ontario not only just bought out non-utility generator (NUG) contracts; along with expired NUG contracts the province has seen 8 natural gas-fired power plants mothballed despite historically low fuel costs for these entirely depreciated generators.

- Germany, the jurisdiction Ontario copied feed-in tariffs from, may lose up to 13 gigawatts of industrial wind turbine capacity by 2023 as their contracts expire and market rates can't cover the operation costs.

The Ontario government is expecting to run up to $25 billion of debt to cover the 20% discount in the global adjustment. By the time it anticipates recovering those funds, there will be no asset (the contracts) left!

Another early feed-in tariff jurisdiction, Spain, didn't allow consumer rates to rise while madly writing contracts, and ended up with an "electricity tariff deficit."

An electricity tariff deficit seems to be exactly what Ontario announced today, and that may be a good thing.

A first step is recognizing the problem.

Spain addressed it's electricity tariff deficit a few years ago by unilaterally cutting rates on the feed-in-tariff contracts.

It's doing well.

_____

Notes:

"Extend and Pretend" is a twitter poll result!

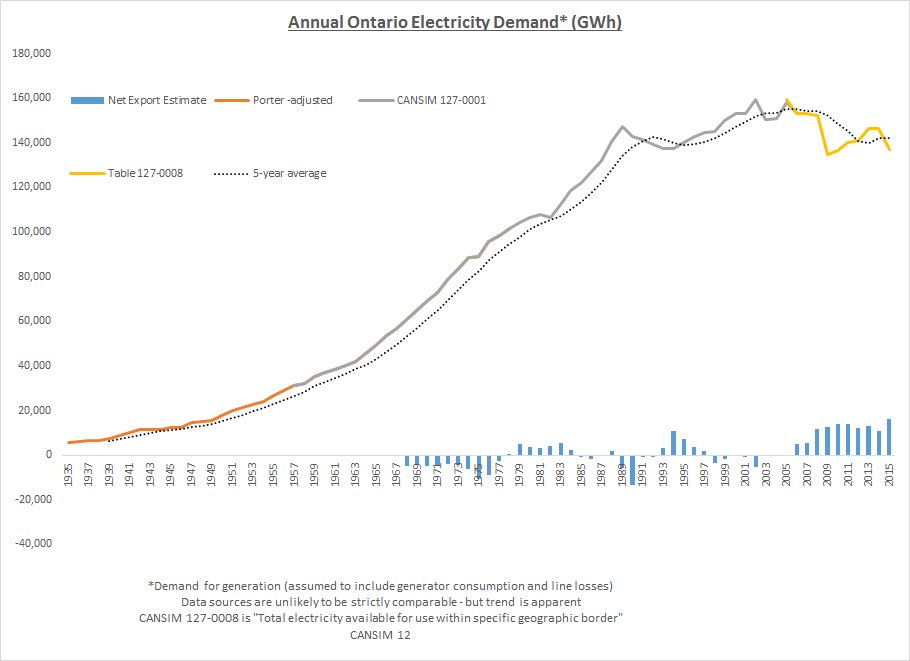

looking at a history of electricity demand in Ontario, it's hard to consider any decade where procuring new supply could have been more of a challenge than it's been over the past 10 years of first declining, then stagnant demand:

No comments:

Post a Comment