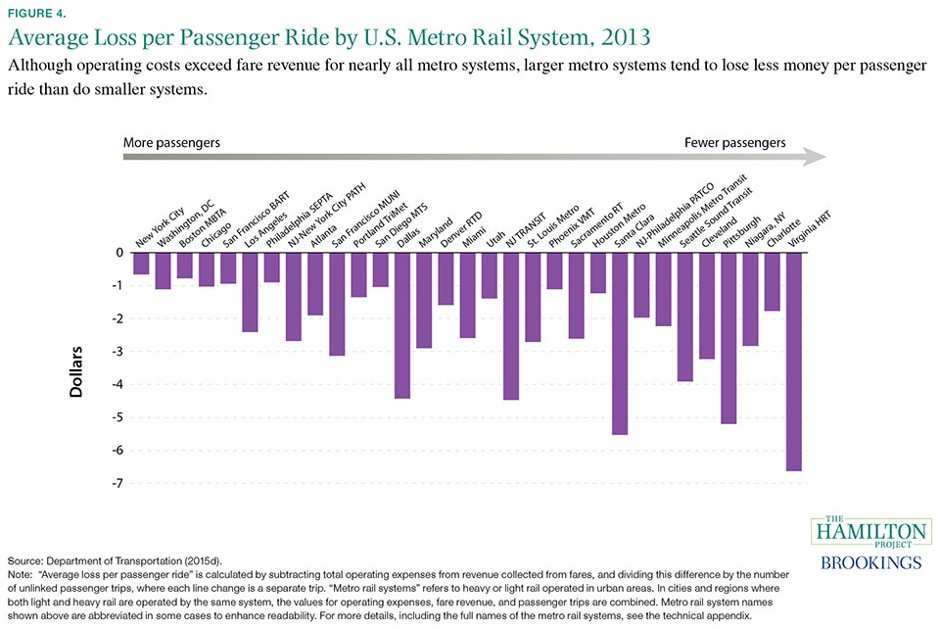

The graphic is from How Much Money U.S. Transit Systems Lose Per Trip, in 1 Chart - despite the title it's an article more informative than the 1 chart:

Some subsidies make more sense than others

The fact that some transit subsidies are inevitable doesn’t mean they can’t be limited. Transport scholar David Levinson has argued that a better funding model would treat public transit like a utility: fully regulated, but covering its costs. In a thoughtful City Journal piece a few years back, Josh Barro suggested that the whole discussion of transit funding must begin with smarter zoning that calls for taller buildings, mixed-use development, and no parking minimums.

In some places it may also make sense to have higher base fares—especially along commuter rail lines that extend into affluent suburbs. As long as the price of driving also rose to match its full cost, transit ridership wouldn’t suffer, and service would likely improve. Cities could still discount fares for low-income users; as Seattle recently showed, new smart card technology makes it easier to put such equity programs in place.

And when it’s time to expand a transit system into a new area, the real estate developers primed to benefit from the new service should pay much of its cost. That’s how they do things in Hong Kong, and it’s no coincidence the city’s MTR transit system makes an enormous annual profit. U.S. agencies will settle for being in the black first, but it’s always nice to have something to work toward.One link I suggest viewing is Targeting Inequality, This Time on Public Transit - perhaps in conjunction with Ross McKitrick's The Principle of Targeting in Energy and Environmental Policy.

No comments:

Post a Comment